Best Payroll Software in India

Streamline Your Payroll Process with India's Most Trusted Payroll Management Software

Why OfficePortal is India's #1 Payroll Software

OfficePortal's payroll software eliminates manual calculations and compliance headaches. Our cloud-based payroll system handles everything from basic salary processing to complex statutory deductions, making payroll management effortless for HR teams across India.

STATUTORY COMPLIANCES

Automatic calculations for EPF, ESI, PT, LWF, and TDS are accurately completed in every pay run.

SALARY COMPONENTS

We have tailor-made salary components and provisions to create custom components according to industry standards.

REIMBURSEMENTS

A simplified process allows employees to claim their expenses and reimbursements through their payroll.

MULTIPLE PAY RUNS

Now you can prioritize your monthly payrolls by location and salary bands, and process multiple pay runs simultaneously.

The Ultimate Payroll Management Solution for Growing Businesses

High-Speed Processing

Process payroll for 500+ employees in under 10 minutes with our automated payroll engine.

100% Compliance Guaranteed

Stay updated with latest TDS rates, EPF changes, and state-wise professional tax automatically.

Significant Cost Savings

Save up to 80% on payroll processing costs compared to manual methods or expensive alternatives.

Enterprise-Grade Security

Your payroll data is protected with 256-bit encryption and stored in secure Microsoft Azure data centers.

Complete Payroll Software Features

Automated Salary Calculations & Processing

Our payroll management software automatically handles complex salary calculations including::

.Basic salary and allowances computation

Loan deductions and advances

Pro-rata salary calculations for new joiners and exits

Multiple Pay Runs: Process different employee groups (permanent, contractors, interns) with separate payment dates.

TDS Calculation & Management

Automatic TDS computation based on latest income tax slabs

Form 16 generation with digital signature

Quarterly TDS return preparation

Investment declaration

Real-time tax optimization suggestions

EPF & ESI Integration

Seamless EPF calculation with latest rates

ESI contribution management

Monthly return generation

Employee-wise contribution tracking

Professional Tax Automation

State-wise professional tax calculations

Timely rate updates for all Indian states

Monthly PT return generation

Payroll Advancements

Contractor Pay Option

We have introduced a Contractor Pay option in the payroll module, enabling users to define a customizable TDS percentage directly within the salary details section of the employee form. This option simplifies payroll management for contractors by allowing precise TDS customization, ensuring compliance with tax regulations. Additionally, it provides the flexibility to accommodate varying tax rates for contractors, making it easier to handle diverse payroll requirements efficiently.

Expense and Reimbursement

Managing expenses and reimbursements is straightforward with OfficePortal. Employees can easily apply for reimbursement of any expenses incurred during official work. Simply navigate to the Expense and Reimbursement section, select the appropriate expense category, provide additional details, and attach supporting bills, all in one convenient place. It's efficient and hassle-free.

Loans

OfficePortal makes providing loans to employees and maintaining records a seamless process. Employers can define various loan types and set their own perquisite rates, offering the flexibility to provide loans at rates that align with their policies. Whether it’s a short-term loan, salary advance, or other types, OfficePortal HRMS simplifies loan management with complete transparency and ease.

Flexible Benefit Plans (FBP)

The Flexible Benefit Plans (FBP) feature allows users to configure a variety of tax-saving components such as meal vouchers, transport allowance, and medical reimbursements directly within the payroll system. This functionality helps organizations optimize employee benefits while ensuring compliance with tax regulations and provides flexibility to accommodate different employee requirements efficiently.

Bank Integration

With Bank Integration, users can generate automated bank advice files for direct salary transfers to employee accounts across multiple banks. This feature streamlines payroll operations, reduces manual intervention, and ensures timely salary disbursements, making payroll management simpler and more efficient for organizations with employees in different banking networks.

Multi-Location Support

The Multi-Location Support feature enables organizations to manage payroll for offices across different states with varying regulations, tax rules, and holiday calendars. It allows users to centralize payroll processes while accommodating local requirements, ensuring accurate calculations and compliance, and providing flexibility to handle diverse operational needs seamlessly

Integration of Payroll and Attendance Tracking Software

Integration of Payroll and Attendance Tracking Software

The OfficePortal Payroll Software is seamlessly integrated with an attendance and leave tracking system to accurately calculate prorated salaries for each employee during the pay run.

The pay run preview feature provides an employee-wise breakdown of the salary calculation, including the number of days processed and a breakdown of each component. This allows for easy editing of individual employee attendance and recalculation of payroll if necessary.

.

TDS Declaration and Proof Validation

TDS Declaration and Proof Validation

The OfficePortal Payroll Software enables employees to submit their income tax declaration at the start of the financial year for tax savings and accurate TDS calculations. During the last quarter of the financial year, employees can submit their proof of investment (POI) to support their IT declaration. Submitted documents are reviewed and approved by designated managers, with the option to recalculate if necessary.

The new tax slab changes for surcharge have now been updated in the TDS computation, ensuring accurate and up-to-date tax calculations. This enhancement helps businesses stay compliant with the latest tax regulations and simplifies payroll processing by automatically reflecting the updated surcharge rates in TDS deductions.</P.

Flexible Submission Period

The organisation can lock and unlock designated periods for employees to submit their IT declarations and POI. This workflow is designed to be more efficient than other payroll software solutions.

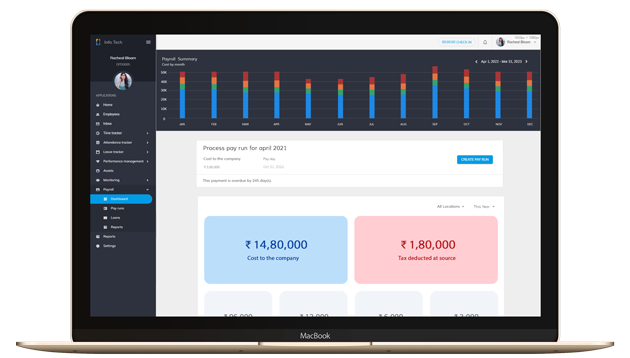

Payroll Summary and Reports

Payroll Summary and Reports

The OfficePortal Payroll Software generates a comprehensive summary report for each new pay run, including a Cost Summary, Employee Summary, and Taxes and Deductions Summary, providing an overview of the organization's financial budgeting and planning.

Draft Status and Pay Run Alterations

Newly created pay runs are in draft status and can be submitted, approved, and completed with payment initiation. The system also provides options to revoke, reject, and edit pay runs, making it easy to make any necessary alterations.

Reports Export and Download

The software's report features include the ability to export data to Excel for easy viewing and interpretation, including Payroll Cost Summary, Employee CTC Details, and Employee Salary Statements. Payslips and TDS calculations can also be easily downloaded in PDF format.

Easy Perquisite Calculation

Easy Perquisite Calculation

With OfficePortal, employers can efficiently manage employee income tax compliances, including the accurate calculation of perquisites as per the Income Tax Act. The platform automates tax calculations, ensuring they are in line with the latest regulations and reducing the risk of errors or non-compliance. This feature simplifies what is typically a complex process, making it easier for employers to handle their tax-related responsibilities.

Additionally, OfficePortal offers real-time updates to stay current with changing tax laws, providing employers with confidence in their tax management. The platform’s user-friendly interface ensures all calculations, including perquisites, are integrated seamlessly, allowing employers to process payroll with accuracy and ease, while staying fully compliant with regulatory requirements..

Flexibility Assured

Flexibility Assured

Customizable Headings

The Employee Salary Statement with Leave Details Report has been enhanced to offer greater customization options. Users can now select which headings to display and rearrange the column order according to their preferences.This improvement provides full control over the report layout, allowing for prioritization of relevant information and ensuring that the report aligns with specific needs. It simplifies the process of reviewing salary and leave details, making data analysis more efficient and intuitive.

Salary Templates

Streamline your payroll management with OfficePortal’s salary templates. You can create and save different templates for employees with similar salary structures, allowing quick assignment and consistent payroll processing. This reduces manual errors and saves valuable time for your HR team.

Payslip Template

With OfficePortal, there’s no need to worry about designing pay slips. The platform offers easy-to-use, predefined pay slip templates that cater to your organization’s requirements. Additionally, these templates are customizable, allowing employers to choose whether to show or hide specific details such as leave balances, bank account information, or loan details. This flexibility ensures each payslip aligns perfectly with your company's payroll policies, providing a comprehensive overview for every employee.

Preview, Approve, and Process Payroll with Workflow Hierarchy

Preview, Approve, and Process Payroll with Workflow Hierarchy

The OfficePortal Payroll Software allows companies to run multiple payrolls in a single month for different locations, departments, and band. The system also gives the option to withhold or skip individual employees from the pay run, if necessary. The initiation and approval of pay runs are based on the configured user roles, giving organizations the flexibility to manage their payroll process efficiently. At the end of the pay run, companies can easily download the bank advice document to credit employee salaries to their bank accounts.

Payroll Imports and Payslip Downloads

The software provides the ability to import previous month's payroll data with the use of dynamic templates. Employees can access their payslips and TDS calculations for every pay run, providing transparency and ease of access to payroll information.

The export feature in the Employee Salary Statement has been enhanced to include the Leave Details Report. For reports with more than 100 records, a notification will now be triggered upon completion, allowing users to download the file seamlessly.

Payroll Software Pricing

Payroll Software Pricing

Customizable Earning Components

Statutory Components

Salary Templates

Payslip Generation and Distribution

Loans and Salary Advances

Expense & Reimbursements

Pay Advice

All these features at just ₹60 per person per month. For more details, visit the OfficePortal Pricing Page.

Flexible Payroll Solutions for Any Industry

Flexible Payroll Solutions for Any Industry

Remote employee payroll management

Complete Allowance Management

Part-time employee management

Seasonal staff payroll

Location-wise payroll processing

Simplified Payroll Implementation

Quick & Easy Setup Process

Configure company details and policies

Set up salary structures and components

Import existing employee data

Connect with attendance systems

Gain Extended Support from Our Exclusive Team

Phone, email, and chat support

Screen-sharing assistance

Video tutorials and documentation

Dedicated account manager for enterprise clients

One-on-one training calls

Regular feature update notifications

Your Data, Protected with Complete Trust and Compliance.

Income Tax Department Approved Calculations

Ensure payroll calculations comply with official tax regulations.

EPF Trust Integration Capabilities

Seamlessly manage employee provident fund contributions with integrated EPF support.

Automated Daily Backups

Protect your payroll data with secure, automatic daily backups.

99.9% Uptime Guarantee

Rely on consistent access and uninterrupted payroll operations.

Multiple Data Center Redundancy

Ensure high availability and security with distributed data storage across centers.

What Our Customers Say About OfficePortal Payroll

See Our Clients Feedback

Using OfficePortal Payroll Software has made payroll effortless for us.

We no longer spend hours calculating salaries and deductions manually — everything is automated and accurate. Since it syncs attendance and leave data seamlessly, payslips are generated instantly after each payrun. It’s simple, efficient, and has made our payroll and appraisal process completely stress-free.

Bijal Kothari

OfficePortal Payroll Software has been a real time-saver for our company. The best part is its automatic salary calculation linked with attendance, which ensures every employee gets the right pay without manual checks. This feature really impressed us, as it reduced errors and made the whole payroll process effortless and accurate.

Shankar Kulkarni

Payroll management has never been so easy! My HRMS OfficePortal handles complex payroll calculations flawlessly. It has reduced the margin for error to almost zero, ensuring our employees are paid accurately and on time.

Shakambari Enterprises

Director

Great experience with this portal. So pleased with the service I received.

Thanks from TrainingYA Institute

Parul CTC

Setup Free Account

It is easy to create a free account. No credit card is required.

Book a Demo

Get a personalised demo; our client service officers can give you a complete insight into OfficePortal.

Personalise OfficePortal

Personalise your OfficePortal with a few simple clicks and start using it.

Setup Free Account

Book a Demo

Personalise OfficePortal

Ready to get started? Start your free trial .

We offer 7 days free trial on our elite version.

Have a question?

Alex Martinez

Payroll software is a computer program that automates the process of calculating, tracking, and paying employees. It helps companies manage their payroll functions, including tracking time worked, calculating salaries and wages, handling tax deductions, and generating paychecks or direct deposit statements.

OfficePortal Payroll Software is a cloud-based payroll system that automates the payroll process, making it more efficient, accurate, and secure. With this business payroll management software, businesses can easily calculate and track employee pay, handle tax deductions, and generate pay stubs and other payroll-related documents. The software can also integrate with other HR and accounting systems, making it easy to manage all payroll-related tasks from a single platform.

Payroll is a critical component of any business, and having a reliable and efficient payroll system is crucial. OfficePortal Payroll Software streamlines the payroll process, reduces the risk of errors, saves time, and ensures compliance with tax laws and regulations. With payroll software in place, businesses can focus on other essential aspects of their operations, such as growing their business and providing exceptional customer service.

The payroll section allows employers to add statutory components like EPF (Employees' Provident Fund), ESI (Employees' State Insurance), Professional Tax, and Labour Welfare Fund. This ensures that all statutory requirements are met and that employees receive their correct entitlements.

With OfficePortal Payroll Software, you can be confident that your payroll processes are in good hands, giving you more time to focus on what matters most: your business and your customers.

The OfficePortal Payroll Management Software operates on a monthly basis, using the one-time pay schedule settings configured by the administrator or designated "Payroll Admin" user. The system is designed to streamline and automate the payroll process, making it efficient and accurate.

To run a successful pay run in OfficePortal HRMS, it is important that the employee salary details and statutory options are properly configured and their attendance for the relevant pay period has been recorded. With these prerequisites in place, the pay run can be initiated to process the employees' salaries.

Yes, it's possible to create multiple pay runs for the same pay period or month in OfficePortal Payroll Management System. To do so, you can utilize the location and band filters to create separate pay runs for specific groups of employees. For example, you can create a pay run for a group of employees based on their location or a group of employees belonging to the same brand. This feature provides you with the flexibility to manage your payroll according to your specific requirements.

In OfficePortal Payroll Software, you can easily pay your employees' bank accounts through the use of bank advice documents. This feature supports various banks, including ICICI Bank, HDFC, HSBC, Kotak Mahindra Bank, and more. You can download csv or excel document and upload it in your corporate net banking portal. If your bank is not currently supported, simply reach out to the Officeportal support team. They will be happy to assist you in getting your bank added to the list of available options, at no additional cost to you.

Yes, it's possible to process employee expenses reimbursement through payroll in the OfficePortal Payroll Software. The software provides a convenient and efficient way to handle these reimbursements. Employees can submit their expenses using the default categories available in OfficePortal, or by creating new categories as per their preference. The submitted expense reimbursements will then be available in the "Inbox" for approval by the employee's reporting manager, who can then proceed with the payment process. This feature streamlines the expenses reimbursement process, making it a hassle-free experience for both employees and managers.

The "Configurable Salary Components" feature in the OfficePortal Payroll Software allows for greater flexibility in the calculation of each component of an employee's salary. In this system, each component can be calculated as a flat amount, a percentage of the cost to the company, or a percentage of the employee's gross salary. Additionally, components can be included or excluded when calculating EPF and ESI wages, and can even be adjusted on a pro-rata basis based on attendance.

The payroll process in OfficePortal can be efficiently managed through a hierarchical workflow system based on user roles. The administrator, with the highest level of authority, has the ability to approve pay runs initiated by the designated "Payroll Admin" user, ensuring a smooth and organized payroll process.

Yes, you can easily generate payroll reports in the OfficePortal Payroll Software to analyze your payroll data. Reports are available for download in Excel format, allowing you to cross-check the accuracy of salary breakups. The following reports are currently available and more will be added in the future: Payroll Cost Summary, Employees' CTC Details, Employees' Salary Statement, EPF Summary, ESI Summary, and Professional Tax Summary.

The OfficePortal Payroll Software covers a wide range of Indian compliance requirements, including Employee Provident Fund (EPF), Employees' State Insurance Scheme (ESI), Tax Deducted at Source (TDS), Gratuity, and Professional Tax. The software is updated regularly to ensure compliance with any changes in government tax policies.

The OfficePortal Payroll Software enables you to easily generate professional and accurate payslips for your employees. These payslips can be easily distributed either in print form or electronically, and employees will be promptly notified of their pay records through the mobile app, email, or push notification.

Yes, the software offers the ability to import data from your existing payroll system, streamlining the transition process. All subsequent tax and salary component calculations will take into consideration the imported data.

Yes, the OfficePortal Payroll Software is available on both iOS and Android mobile devices. Simply follow this link to download and install the mobile app for your convenience.

Yes, the software comes with comprehensive customer support, including assistance via phone, email, and live chat to ensure that any questions or issues are promptly addressed.

The Salary Template in the OfficePortal Payroll Software serves as a pre-defined salary structure that can hold a variety of components such as Basic Pay, House Rent Allowance (HRA), Medical Allowance, Fixed Allowance, Employee Provident Fund (EPF), Employees' State Insurance Scheme (ESI), and more. Multiple salary templates can be created to accommodate different levels of employees within an organization. When creating a salary structure for an individual employee, a salary template can be used as-is or a new structure can be created on-the-fly. This feature streamlines the salary structure creation process and saves time.

Yes, OfficePortal allows you to run payroll based on employment type. By moving the contractor employees to the "Contractors" type, you can process their payroll separately from regular employees during payrun.

OfficePortal Payroll Software ensures 100% accurate TDS calculations, automatically updated with the latest income tax slabs and government rules. The system also provides real-time tax optimization suggestions, helping employees reduce liability with eligible exemptions and deductions. Many CA firms even rely on OfficePortal’s payroll engine for accuracy in their clients’ payroll processing.

Yes. OfficePortal supports multi-location payroll management, allowing you to handle different state-wise compliance requirements, professional tax rules, and holiday calendars. This is especially useful for companies with branches across India, ensuring smooth payroll processing without errors or compliance risks.

Most companies get fully onboarded within 3–5 business days. Our experts assist you with setup, employee data migration, salary structure configuration, and statutory compliance checks. You can process your first payroll run within a week with minimal training, supported by our step-by-step guidance.

Yes. Form 16 is auto-generated for all employees at the end of the financial year. The software supports digital signature integration, making it easy to issue authenticated Form 16 documents in PDF format, which employees can instantly download from their self-service portal.

Absolutely. OfficePortal provides data migration support, enabling you to import employee records, salary structures, historical payslips, and compliance data from Excel or other payroll software. Our onboarding team ensures a smooth transition without data loss.

We offer quick and reliable multi-channel support via phone, email, and live chat. Our team provides screen-sharing sessions, onboarding assistance, and access to a comprehensive knowledge base. Premium customers also get a dedicated account manager for priority support and customized guidance.

Compliance updates are released immediately whenever government rules change. Whether it’s revised TDS slabs, EPF rates, or state-level professional tax updates, OfficePortal ensures your payroll stays 100% compliant at all times without manual intervention.

Yes. OfficePortal allows you to set up different salary structures and pay runs for permanent staff, contractors, and temporary employees. This flexibility ensures that compliance, taxation, and benefits are correctly applied to each employee type.