Cracking the CTC Breakdown: Analyzing ₹20,000 Monthly Salaries and their Components

Introduction:

Understanding the Salary Components and CTC Breakdown of a ₹240,000 Annual, a monthly salary of ₹20,000 Package for an Indian Employee

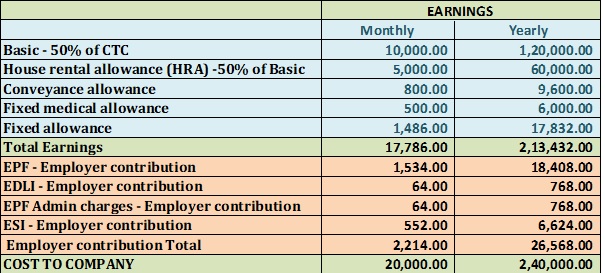

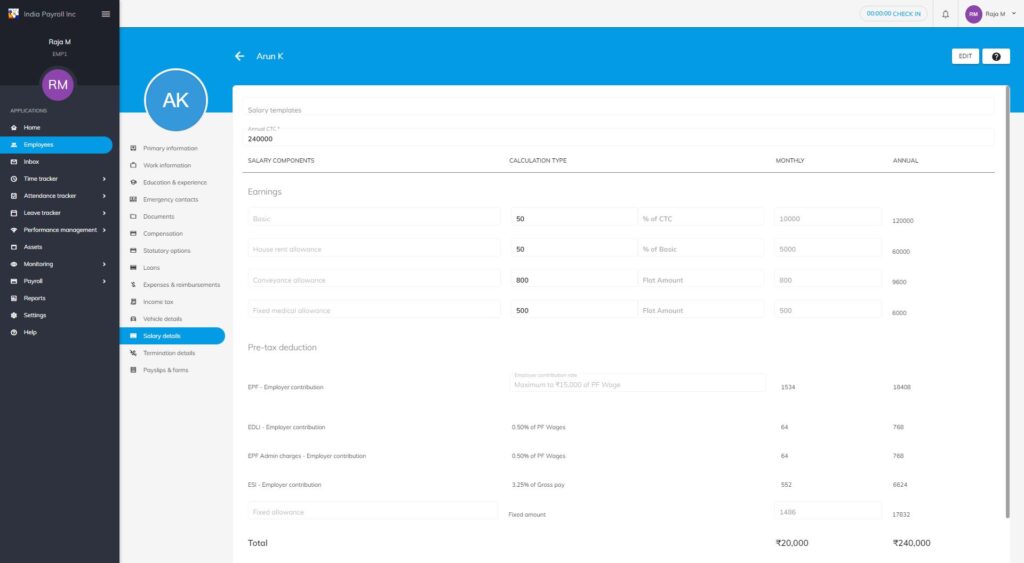

In India, employee compensation packages are commonly structured to include various salary components and benefits. These components, such as Basic, HRA, Allowances, and statutory contributions like EPF and ESI, form part of the Cost to Company (CTC) offered to an employee. In this article, we will explore the breakdown of a ₹2,40,000 CTC, highlighting the different components and their significance in an Indian employee’s salary package. In simple, we will analyze a monthly salary of ₹20,000, with a breakdown of the different components, including Basic, HRA, conveyance allowance, fixed allowance, other allowance, and employer’s contributions towards EPF (including EDLI and admin charges) and ESI.

Salary Components

Salary components refer to the various elements that make up an employee’s total compensation package. These components are designed to provide a comprehensive breakdown of an employee’s earnings and benefits.

Basic Salary:

The Basic Salary is the fixed portion of an employee’s salary and serves as the foundation for other benefits and calculations. It is a taxable component and is typically between 40 to 60 percent of the total CT. Let’s assume a Basic Salary is ₹120,000 which is 50% of the CTC amount of ₹2,40,000 and in this case, the Basic Salary is ₹10,000 / month.

To learn more click this link Basic salary

House Rent Allowance (HRA):

House Rent Allowance is provided to employees to cover their rental expenses. The actual HRA amount depends on factors such as the employee’s salary, the city of residence, and the rent paid. Usually, HRA is calculated at either 40 or 50 percent of the Basic Salary. Assuming an HRA of 50% of the Basic Salary in this case, it is ₹60,000 which is equal to a monthly HRA of ₹5,000. It is partially exempt from income tax, subject to certain conditions.

To learn more click this link. House Rent Allowance,

Allowances:

Allowances are additional monetary benefits provided to employees to meet specific expenses related to their job role. Some common allowances include conveyance allowance, medical allowance, other allowances, and special allowances. The specific breakdown of allowances may vary depending on the employer’s policies. For this example, let’s consider the following allowances.

Conveyance Allowance:

Conveyance Allowance is provided to employees to cover transportation costs related to work. It is usually a fixed amount. In this case, the Conveyance Allowance is ₹9,600 which is a monthly ₹800.

To learn more click this link. Conveyance Allowance,

Fixed Allowance:

A Fixed Allowance is a predetermined sum provided to employees to cover specific expenses associated with their job roles. It is a fixed amount and is determined by the employer. Here, the Fixed Allowance is ₹6,000 which is a monthly ₹500.

Other Allowance:

The Other Allowance is miscellaneous provided to employees for various expenses. It may include components such as medical allowance, special allowances, or any other allowances specified by the employer. In this example, the Other Allowance is ₹17,832 which is monthly ₹1,486.

Employer’s EPF Contribution (including EDLI and Admin Charges):

EPF (Employee Provident Fund) is a mandatory savings scheme for employees in India. The employee and employer contribute a percentage of the Basic Salary towards the EPF. The employer’s contribution includes charges such as Employee Deposit Linked Insurance (EDLI) and administrative charges. The specific rates may vary, but assuming the employer’s contribution is 12% of the Basic Salary, the contribution, in this case, is ₹1,200.

Employer’s ESI Contribution:

ESI (Employee State Insurance) is a social security and health insurance scheme for Indian employees earning below a certain salary threshold. The employer is responsible for contributing 3.25% of the employee’s gross salary, while the employee contributes 0.75%. However, the ESI contribution is applicable only if the employee’s gross salary is below ₹21,000 per month.

Salary Breakdown:

Now, let’s calculate the monthly salary using the given components:

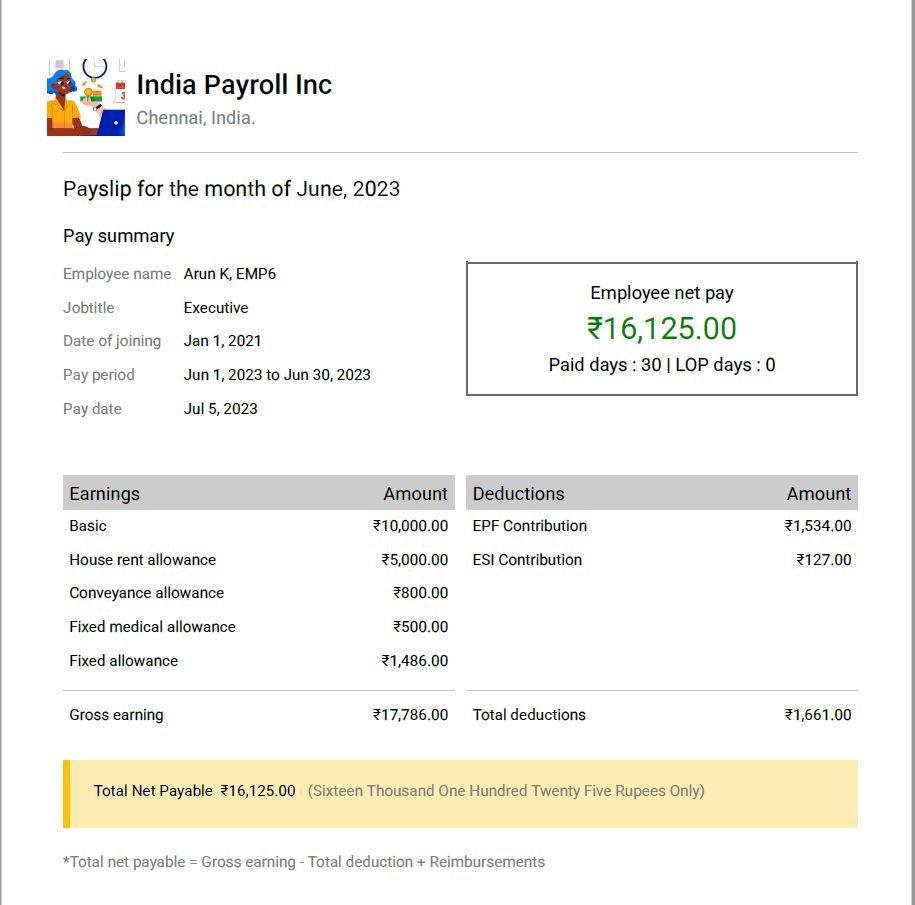

A payslip generated for Mr. Arun based on his salary details configured for June 2023, assuming he was present for all the days without LOP can be seen in the below screenshot.

Conclusion:

In this example, a ₹240,000 CTC which is a monthly salary of ₹20,000 is broken down into different components, including Basic Salary, HRA, conveyance allowance, and fixed allowance. Both employees and employers need to understand the various salary components and their impact on the overall compensation package. By comprehending the CTC structure, employees can better plan their finances, while employers can effectively communicate the value of the benefits provided to their workforce.