Basic salary definition #

The basic salary is the foundation of an employee’s salary structure and is used to calculate other components of the salary and other perks. Basic salary is typically calculated as a percentage of the employee’s total compensation package and is used to determine various deductions such as income tax, provident fund contributions, and gratuity Basic salary is usually determined by the employee’s job role, experience, qualifications, and other factors such as cost of living and industry standards. We’ll explore the basics of the basic salary component in Indian payroll.

The basic salary is the minimum amount that an employee is guaranteed to receive and is usually a predetermined percentage of their total salary. The basic salary is used to calculate the employee’s gross salary, which includes all benefits and allowances. In OfficePortal is built with the salary calculations method from CTC and considering the standard practice in the Indian payroll system.

How is the Basic Salary calculated? #

The basic salary component is calculated as follows:

The basic salary is usually a predetermined percentage of the employee’s total salary and is based on the employee’s job level, experience, and qualifications. It is also influenced by industry norms and the company’s policies. In some cases, the basic salary may be renegotiated during an employee’s performance review or as part of a compensation package.

Percentage of total compensation package: #

The basic salary is typically calculated as a percentage of the employee’s total compensation package. The percentage can vary depending on the company’s policies and the employee’s job role and level of seniority. For example, the basic salary may be 40-50% of the total compensation package for entry-level employees and 60-70% for more senior employees.

The remaining percentage of the total compensation package is usually made up of other components such as bonuses, incentives, and benefits. The percentage of basic salary in the total compensation package can vary between companies and industries and can also change based on the company’s financial position and budget. It is important for employees to understand the breakdown of their total compensation package, and how much of it is basic salary, to plan their finances and budget accordingly.

Example

- Annual CTC – 8,00,000/-

- Basic 50% Of CTC – 4,00,000/-

- HRA- 50% Of Basic – 2,00,000/-

- Conveyance Allowance- – 19,200/- (1600/- per month)

- Medical Allowance- – 15,000/- (1250/- Per month)

- Special Allowance- – 1,65,800/-

How the gross salary is calculated? #

The gross salary is calculated by adding up the basic salary, DA, HRA, CCA, and any special allowances.

Add dearness allowance (DA):

DA is a cost-of-living adjustment allowance that is paid to employees to offset the impact of inflation on their purchasing power. The DA rate is periodically reviewed and revised by the government.

Add house rent allowance (HRA):

HRA is an allowance paid to employees who live in rented accommodation. The amount of HRA is calculated as a percentage of the basic salary, depending on the location of the employee’s residence.

Add city compensatory allowance (CCA):

CCA is an allowance paid to employees who work in specific metropolitan cities to compensate for the high cost of living in those areas.

Add any special allowances:

This additional allowance is paid to employees for specific reasons, such as working in difficult or remote locations.

How does Net Salary arrive? #

Statutory deductions, such as provident fund (PF), employee state insurance (ESI), and professional tax, are deducted from the gross salary to arrive at the net salary.

Importance of basic salary in Indian payroll #

Basic salary is an important component of an employee’s total income and is often used as a benchmark for determining raises and promotions. It is also used to determine eligibility for certain benefits such as housing loans and car loans. Understanding basic salary is important for both employers and employees as it helps them make informed decisions about compensation, deductions, and benefits.

In India, Basic salary is considered one of the most important aspects of salary structure, as it is used to calculate other deductions such as Income tax and provident fund contributions.

Basic salary also plays a crucial role in determining the overall cost to the company (CTC) of an employee.

Factors that determine basic salary: #

- Job role and responsibilities: The job role, level of responsibilities, and the level of seniority of an employee often play a major role in determining basic salary.

- Experience: An employee’s level of experience, tenure, and track record in their field can also be a significant factor in determining basic salary.

- Education and qualifications: An employee’s level of education and professional qualifications can also be considered when determining basic salary.

- Industry standards: Basic salary can also be determined based on the criteria and norms of the industry in which the employee works.

- Cost of living: The cost of living in the area where the employee works can also be considered when determining basic salary.

- Market demand and supply: Basic salary can also be determined based on the market demand and supply for a particular job role.

- It is important to note that these factors can vary from company to company and even within the same company for different job roles and levels.

Comparison with other countries: #

Basic salary can vary significantly between countries, depending on factors such as cost of living, the standard of living, and economic conditions. For example, the basic salary in developed countries such as the United States and Canada may be higher than in developing countries such as India and China.

Factors such as taxes, social security contributions, and benefits can also affect the total compensation package and the percentage of basic salary. Additionally, the cost of living can also vary significantly between countries and can affect the overall value of the basic salary. Therefore, employees need to consider these factors when comparing basic salaries in different countries and understand their elemental salary purchasing power.

It is also important to note that the salary structure can be different in other countries and may not include the concept of a basic salary. Comparing basic salaries with other countries can be useful for employees looking to work abroad or for companies looking to expand their operations in other countries.

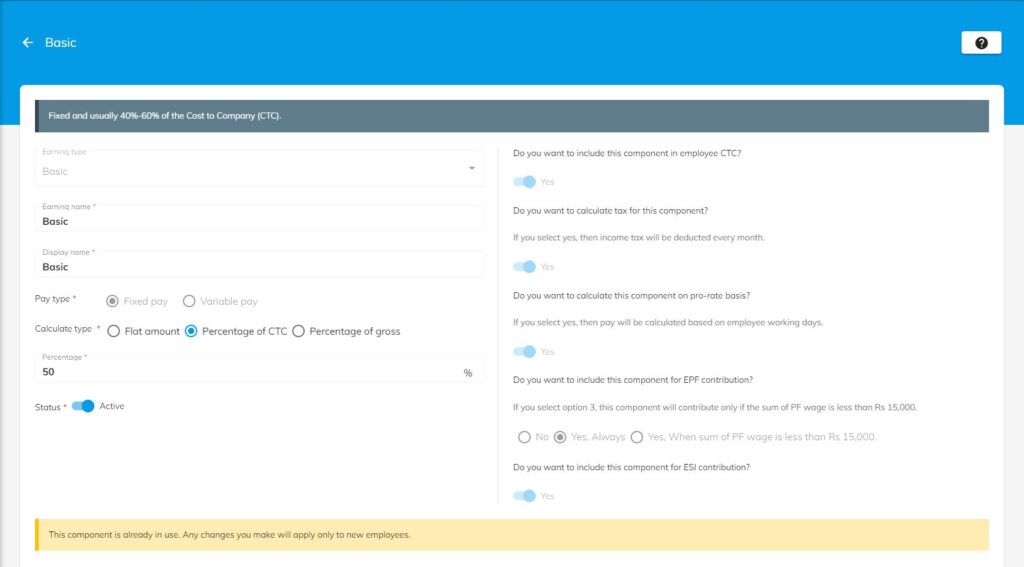

How is Basic salary implemented in OfficePortal? #

Let’s have a look at how the basic salary component is configured in OfficePortal. Here is the screenshot of the basic salary component under payroll settings.

Basic is configured as fixed pay and the calculation can be chosen as follows.

- Flat Amount

- Percentage of CTC

- Percentage of gross

When you have selected any one of the above options, then you will be able to enter the required values in the below column and right now it is displayed as 50% since the percentage of CTC has been selected above. The percentage can be edited as per the CTC structure of the user’s preferences likewise for the remaining other two options. But, you have to make sure that this component is not used in any of the employee’s salary details otherwise it will be non-editable.

The statutory settings are configured as default for considering the basic salary as per the Indian statutory compliance.

Conclusion #

In conclusion, the basic salary component is calculated as the fixed amount of basic salary, plus any additional allowances, minus any statutory deductions, to arrive at the employee’s cost to the company (CTC) in the Indian payroll. Understanding how the basic salary component is calculated is essential for both employees and employers in ensuring a fair and transparent payroll system.

OfficePortal is built with the salary calculations method from CTC and considering the standard practice in the Indian payroll system. Click here to learn more about OfficePortal Payroll Software.

We offer 7 days free trial on our elite version. No Credit card required.